HSBC’s IPO Banker Exodus Affects Middle East Strategy?

Introduction HSBC’s presence in the Middle East market has once again been shaken asHSBC’s key IPO banker is leaving the company, which is said to have a particularly large impact on the Middle East market. Bloomberg reports that the outflow of bankers could affect the company’s IPO operations. Given the surge in IPO activity in Middle Eastern markets, this volatility directly affects HSBC’s competitiveness. The reasons behind the move and its implications are also attracting attention.

Referenced Article:

HSBC Is Said to Lose Another Top IPO Banker for the Middle East

Source: Bloomberg Markets

Current IPO Activity in Middle Eastern Markets and Its Impact

IPO activity in the Middle East is expected to increase rapidly between 2024 and 2025.

- In 2024, the number of IPOs exceeded 30, a two-fold increase over the previous year!

- Transaction value in this market totals over $10 billion and continues to grow

- Major corporate IPOs include Saudi Aramco and Etihad Airways, and fundraising activity is strong.

The fact that HSBC is losing its IPO banker in the Middle East puts its ability to meet the growing needs of these markets to the test. One factor that will have an impact is the increasing number of IPOs in the technology and energy sectors, which are new growth areas. In particular, large projects in the renewable energy sector are underway in the Middle East. IPOs play an important role as part of securing financing for these projects.

Industry Impact of HSBC’s Talent Exodus and Future Prospects

The exodus of talent at a major financial institution like HSBC has repercussions for the industry as a whole. Such a move could also be a catalyst for a change in strategy for other banks.

- As investment banking in Middle Eastern markets intensifies, HSBC will need to recruit new talent.

- Talent outflows can also facilitate a shift of market share to competitors.

- In the past, other multinational banks have taken market share by exploiting HSBC’s weaknesses.

In the future, strategic recruitment and strengthening of its diversified client portfolio will be essential if HSBC is to maintain its position and achieve further growth in the Middle East market. The exodus may also allow other banks to focus on the Middle East market and access the client base that HSBC had retained. This has the potential to invigorate competition and diversify business opportunities in the Middle East financial market as a whole, and how HSBC responds to this change will be a key factor in determining future market trends.

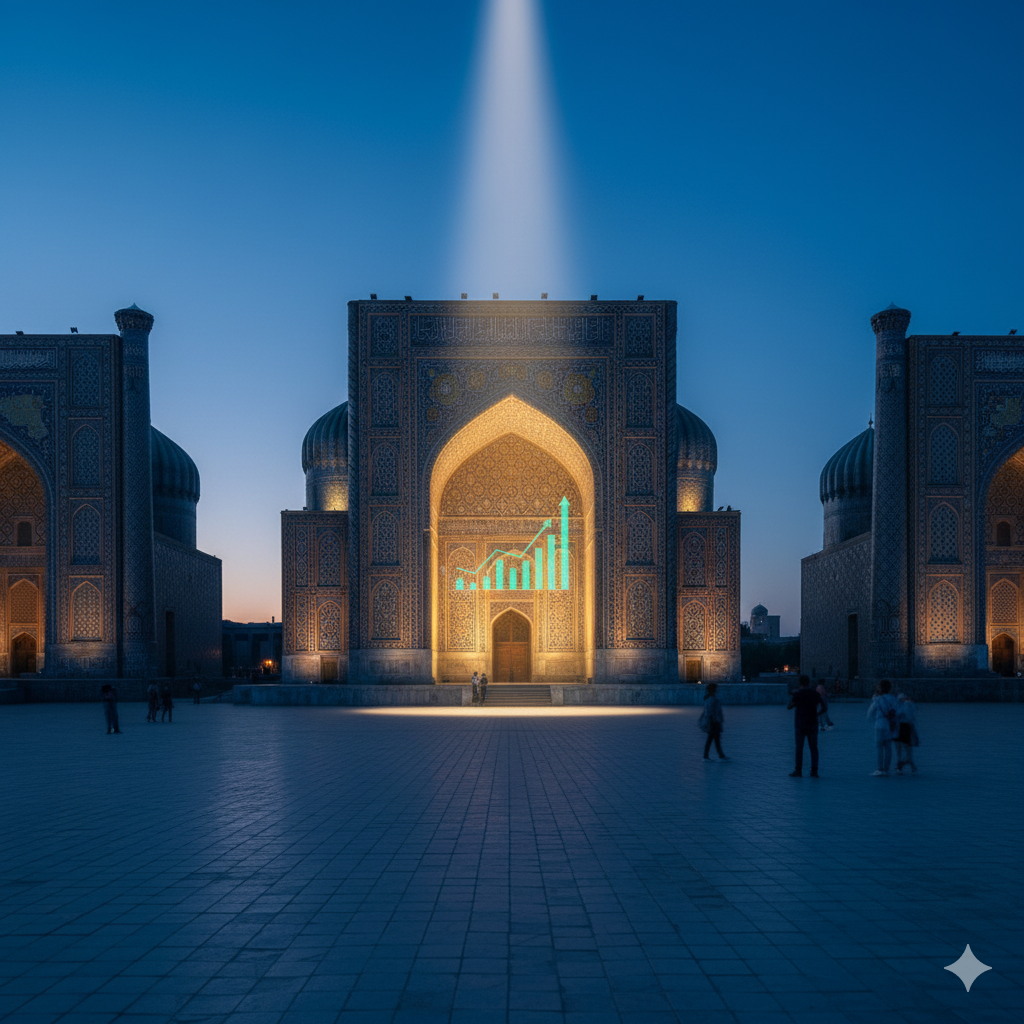

Uzbekistan Market Outlook and Risk Management

Learn more about the possibilities and risks in investing in Uzbekistan.

The Uzbekistan market offers many opportunities for investors, but also comes with inherent risks.

Uzbekistan’s attractiveness as a market is due to the government’s strong reform drive. In particular, the policy of economic diversification is a major factor in attracting foreign investment.

[Legal Risks].

Changes in the legal system can affect investors. In Uzbekistan in particular, bureaucratic procedures are often complex relative to existing laws, so working with a local law firm is essential.

Measures:

- Enter into an advisory contract with a local law firm

- Regularly assess the latest legal changes

- Thoroughly review contracts with local partners

Economic risk

Although the economy of Uzbekistan is stable, there is a risk of inflation and currency fluctuation.

Measures:

- Use of financial hedging instruments (e.g., currency swaps)

- Regularly analyze economic indicators in the local market

- Increase holdings of assets denominated in foreign currencies

[Social risk

Uzbekistan’s social culture is unique, with business practices specific to the region.

Measures:

- Understand and adhere to local business etiquette

- Training multilingual staff

- Building relationships with local partners (emphasis on trust)

Future strategies for investment in Uzbekistan

Practical advice for the Uzbekistan market includes

- Diversify your investment portfolio: consider sectors such as agriculture, real estate, and manufacturing.

- Investment planning with a long-term perspective

- Regular market research and analysis of economic trends

- Development of partnerships and joint projects with local companies

- Introduction and promotion of innovative technologies

Provision of specific checklists:

- Verification of contract documents and legal compliance

- Formulate and implement risk management

- Periodic assessment and evaluation of the local investment environment

- Conduct periodic reinforcement training

- Develop culturally sensitive business strategies

In Summary: Why You Should Act Now

2024 is the perfect time to invest in Uzbekistan M&A.

The government’s preferential policy for foreign investment is scheduled to continue until 2027, and early entry will maximize benefits.

The current corporate tax rate of 12% is scheduled to be gradually increased beginning in 2026, making now the most favorable time to invest.

Why you should start now:

- Secure quality local partners

- Benefit from the most favorable tax regime

- Gain first-mover advantage

- Build positive relationships with governments

Now is your chance to realize annual returns of 30-35%.

Next Steps:

We strongly recommend that you begin consulting with an expert now and begin developing a concrete investment plan.

References for this article

HSBC Is Said to Lose Another Top IPO Banker for the Middle East

Source: Bloomberg Markets | See original article for details

コメント